Steps for Digital Signature in Tally | How it WorksStep 1. Create Regular GST Invoices, Receipts etc in Tally

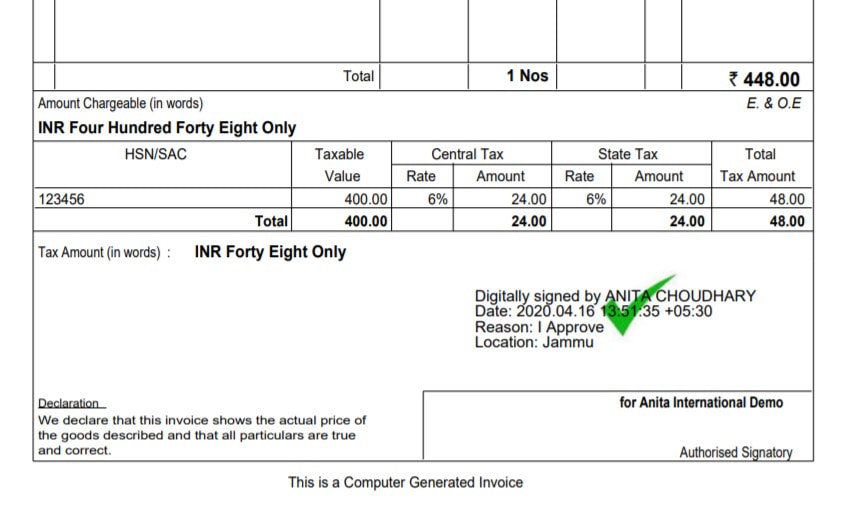

Step 2. Download & Install TCP File. Configure the AddOn from TDL & Sales Voucher Type. Step 3. Make sure DSC (Digital Signature Certificate) is valid and Dongle is connected. Step 4 Select Digital Signature Button on Sales Invoice & Enter DSC Password. Digitally Signed PDF is successfully created. Sample preview below. Benefits of Digitally Signing Invoices

|

Download NowFree Trial of Digital Signature

OFFER PRICE : Rs 3500 (Excl. GST) Call or Whatsapp on 9796504444 for free Demo

|

FAQ for Digital Signature in Tally Prime Invoice

Are there any annual charges for Module ?

This is one time license, no annual charges

Compatible with TallyPrime ?

Works with both Tally.ERP 9 and TallyPrime

Compatible with which Operating system ?

The add-on is compatible with Windows 7 onwards, but we recommend Windows 10 or above

Our system got formatted, can we install the add-on again ?

Yes, you will have to download the system files to Tally Folder, along with installation of Tally TCP

We have multiple companies in Tally. Will this digital signature work on all of it ?

One needs to check with CA for which signature needs to be used with which company. The add-on allows you to use the add-on with all the companies against valid Tally serial number for which the add-on was purchased.

What happens if the certificate expires?

Please connect with the Digital signature token provider. They will renew the signature post due diligence. The token is good to be used with Tally again.

This is one time license, no annual charges

Compatible with TallyPrime ?

Works with both Tally.ERP 9 and TallyPrime

Compatible with which Operating system ?

The add-on is compatible with Windows 7 onwards, but we recommend Windows 10 or above

Our system got formatted, can we install the add-on again ?

Yes, you will have to download the system files to Tally Folder, along with installation of Tally TCP

We have multiple companies in Tally. Will this digital signature work on all of it ?

One needs to check with CA for which signature needs to be used with which company. The add-on allows you to use the add-on with all the companies against valid Tally serial number for which the add-on was purchased.

What happens if the certificate expires?

Please connect with the Digital signature token provider. They will renew the signature post due diligence. The token is good to be used with Tally again.

Digitally Signed - GST Compliant Invoices

Digital Signature Certificate (DSC) is a means of electronically signing documents to verify the authenticity of the person signing. It can be substituted for a physical handwritten signature. DSC is valid only if it created as per the provisions laid down under the Information Technology Act.

As part of Goods and Services Tax (GST) regulations in India, all GST filings that include forms and invoices are required to be digitally signed. This makes digital signatures compulsory for e-filing of income tax returns, e-filing for a Registrar of Companies, online auctions (like e-tenders), challans, consignment notes, delivery orders, etc.

As part of Goods and Services Tax (GST) regulations in India, all GST filings that include forms and invoices are required to be digitally signed. This makes digital signatures compulsory for e-filing of income tax returns, e-filing for a Registrar of Companies, online auctions (like e-tenders), challans, consignment notes, delivery orders, etc.

Types of Digital Signature

Class 1: It can be issued for both individual and professional use. It provides the assurance that information provided in the document or digital data provided by the owner should not conflict with the information in the well-recognized database.

Class 2: It is being issued for both personal and private individuals. It can include the transactions having a substantial value of risk or fraud. It can also include access to private information and access of malicious is substantial.

Class 3: It is also being used or issued to organizations and individuals as well. This provides high-level security for the data. The threats to data are at high risk or the failure of security services is also high and its results are very important.

Class 2: It is being issued for both personal and private individuals. It can include the transactions having a substantial value of risk or fraud. It can also include access to private information and access of malicious is substantial.

Class 3: It is also being used or issued to organizations and individuals as well. This provides high-level security for the data. The threats to data are at high risk or the failure of security services is also high and its results are very important.

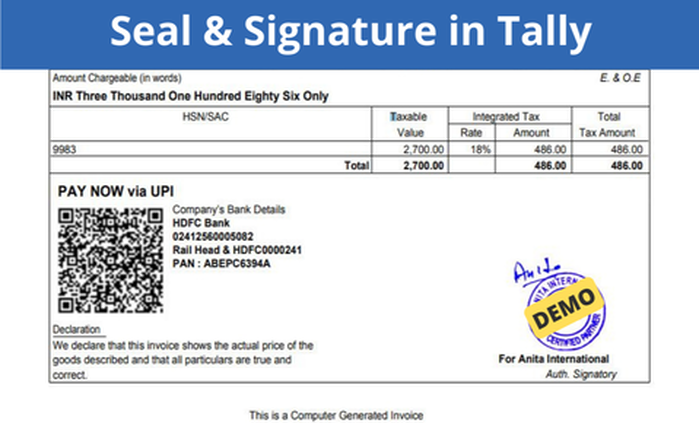

More add-ons : Seal and Sign in Tally Invoice

The requirement is to sign all the invoices, one can use the format of manual signature using stamp or sign or stamp and sign both in one go in invoice. The customization can be done to adjust the signature and the invoice will be modified accordingly.

The customer decides on the format of signature required and the same can be customized as per the requirement. This will save alot of manual effort and help you in compliance. The authorized Signatory TDL will help you sign the high volume invoices being generated on regular basis.

To know More, Click Here.

The customer decides on the format of signature required and the same can be customized as per the requirement. This will save alot of manual effort and help you in compliance. The authorized Signatory TDL will help you sign the high volume invoices being generated on regular basis.

To know More, Click Here.